Business cycles and Forecasting Economics Grade 12 Notes and Study Guide. Business cycles refer to fluctuations in economic activity or production over several months or years. They seem to indicate a long-term trend, typically involving shifts over time between periods of rapid economic growth (expansion or boom), and periods of stagnation or decline (contraction or recession).

Forecasting relates to the economic indicators used to forecast the trends in the business cycle. ReadBusiness Cycles and Forecasting Economics Grade 12 Questions and Answers

BUSINESS CYCLES AND FORECASTING GRADE 12 NOTES – ECONOMICS STUDY GUIDES

Overview

| TOPIC | CONTENT | CONTENT DETAILS FOR TEACHING, LEARNING AND ASSESSMENT PURPOSES |

| 2.Business cycles | Analyse and explain business cycles, show how they are used in forecasting

|

HOT QUESTION: Compare and contrast endogenous and exogenous explanations of business cycles

HOT QUESTION: Explain how supply side and demand side policies would be used to stimulate economic activity in the smoothing of cycles

HOT QUESTION: Make use of a given real business cycle diagram and explain why it serves as a forecasting model |

2.1 Key concepts

These definitions will help you understand the meaning of key Economics concepts that are used in this study guide.

| Term | Definition |

| Business cycle | Successive periods of growth and decline in economic activities |

| Depression | Economic activity is at its lowest. Deepening of the recession |

| Economic indicator | Used to measure trends in the economy, e.g. GDP |

| Peak | Point where the economic expansion is at its highest |

| Phillips-curve | Illustrates the relationship between unemployment and inflation |

| Recession | A negative economic growth for at least two successive quarters |

| Trough | Point where the economic contraction is at its lowest |

2.2 The composition and features of business cycles

2.2.1 Nature of business cycles

- Changes in economic activity are recurring but never exactly the same or of the same magnitude.

- Different circumstances and expectations cause consumers and producers to respond differently to initiating forces.

- The duration and amplitude of every business cycle will be different.

- Business cycles are recognised by the following:

- Two periods namely contraction and expansion;

- Two turning points namely trough and peak;

- Four phases, namely recovery, prosperity, recession and depression.

Make mobile notes (see instructions on page xiv) to learn the meanings of these basic concepts.

2.2.2 Demonstration/diagram of a business cycle

Figure 2.1 below shows economic activity over an extended period of time as the economy moves between periods of expansion and periods of contraction.

Figure 2.1 Business cycles (trend line)

As shown in Figure 2.1, economic activity clearly shows periods of contraction (recession/depression) and periods of expansion (recover/prosperity) in the economy.

- Economic activity is shown by the upward and downward movements of the curve.

- A period where there is a general increase in economic activity is known as an upswing.

- A period of general decline in economic activity is called a downswing.

- The business cycle oscillates between the upper (peak) and lower (trough) turning points along a trend line.

- The length of the business cycle is measured from peak to peak or from trough to trough.

- The entire period from the peak to the trough is known as the downswing.

- The entire period from the trough to the peak is known as the upswing.

- The period immediately before and through the upper turning point of the cycle is called the boom.

- The period immediately before and through the lower turning point is known as the slump.

- The trend line is the long-term average position or pattern.

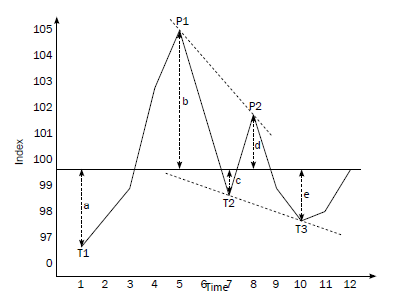

2.2.3 Real (actual) business cycle

- An actual business cycle is obtained when the effects of irregular events, seasons and long-term growth trend are removed from the time series data.

- Figure 2.2 shows the real GDP of South Africa over a 12 year period displayed in a jagged diagram.

- The length or duration of the cycle is measured from trough to trough or peak to peak.

- The distance of the peaks and troughs from the trend line is known as the amplitude and shows the severity of cyclical fluctuations.

Figure 2.2 The real business cycle - The percentage point difference of successive peaks and troughs can be calculated e.g. a + b (3 + 5 = 8) compared to b + c (5 + 1.5 = 6.5).

Exogenous includes, amongst many others, the monetarist view.

Endogenous focuses mainly, but not only, on the Keynesian approach

2.3 Explanations

There are numerous theories as to the causes of business cycles. Among these are the monetarist approach and the Keynesian approach. The government uses monetary instruments such as interest rates to mediate these business cycles.

2.3.1 The exogenous explanation

Exogenous variables are those independent factors that can influence business cycles and originate outside the economy. Some economists believe that business cycles are caused by exogenous factors such as those described below:

- The monetarists believe markets are inherently stable and disequilibrium is caused by incorrect use of policies, e.g monetary policy.

- Weather conditions and market shocks cause upswings and downswings.

- Governments should not intervene in the market.

- Sunspot theory based on the belief that increased solar radiation causes changes in weather conditions.

- Technological changes.

Figure 2.3 is based on the view that economics are generally stable. This is illustrated by the thick trend line representing the normal progress of a growing economy. Movements away from the trend are caused by exogenous factors, for example, inappropriate monetary policy.

Figure 2.3 Monetarist approach

2.3.2 The endogenous explanation

Endogenous variables are dependent variables. This follows the belief that economic growth is primarily the result of endogenous and not external forces.

- This is often called the Keynesian view.

- The Keynesian approach holds the view that markets are inherently unstable and therefore government intervention may be required.

- The price mechanism fails to co-ordinate demand and supply in markets and this gives rise to upswings and downswings.

- Prices are not flexible enough (e.g. wages).

- A business cycle is an inherent feature of a market economy.

- Indirect links or mismatches between demand and supply are normal features of the economy.

Figure 2.4 helps to illustrate the Keynesian view of the business cycle. The thick cycle line indicates the endogenous nature of the business cycle, while the thinner trend line shows that the economy is inherently unstable. The argument is that business cycles are a natural part of market economies and can have a major impact on the overall performance of an economy.

Figure 2.4: Keynesian approach

2.3.3 Types

The business cycle is one kind of cycle found in market economies. Other less obvious kinds occur less regularly:

- Kitchen cycles: last between 3 to 5 years caused by adapting inventory levels in businesses.

- Jugler cycles: last from 7 to 11 years and are caused by changes in net investments by government and businesses.

- Kuznets cycles: last between 15 to 20 years, caused by changes in activity in the building and construction industry.

- Kondratieff cycles: last longer than 50 years, caused by technological innovations, wars and discoveries of new deposits of resources e.g. gold.

2.4 Government policy

Government can use monetary and/or fiscal instruments to help stabilise business cycles, also called “fine tuning” the economy.

2.4.1 Policy instruments

MONETARY POLICY – can be defined as policies used by monetary authorities (SARB and MPC) to change the quantity of money in circulation as well as the interest rates, with the aim to stabilise prices, reach full employment and achieve high economic growth.

The size of the M3-money stock is an important determinant of the quantity of money. The following TWO theories explain changes in the quantity of money and its impact on the economy:

- The quantity theory of money shows how an increase in the stock of money can lead to an increase in the inflation rate and a decrease in the buying power of money.

Quantity theory-equation:

MV = PT

Where: M = Total stock of money

V = Velocity of money

P = Prices of goods and services

T = Quantity goods and services

When the stock of money (M) increases, prices (P) will rise and because production (T) cannot be increased immediately it will lead to INFLATION, assuming velocity (v) remains constant. - The second theory links the change in deposits and the cash reserve requirement. If the amount of new deposits increase, the money multiplier kicks in:

Tm = ΔD × 1/rd

Where: Tm = Total stock of money at the end of the process

ΔD = The initial inflow of new money to the banks/new deposits

Rd = Minimum cash reserve percentage kept by banks.

It can be seen that a relatively small deposit of R1 000 with a relatively small cash reserve requirement of 5% (0,05) may lead to a relatively large increase in the total stock of money.

Tm = 1 000 × 1/0,05 = 1 000 × 20 = R20 000

- Keeping the TWO theories in mind, the central bank can use the following instruments separately or jointly from its arsenal of monetary and related policy instruments in a selective or discretionary manner:

- Open market transactions

The SARB can directly increase/decrease the supply of money by buying/selling government securities in the open market. - Interest rates

If banks experience a shortage of funds in the money market, they are accommodated by the SARB, when they are allowed to borrow money through the Repo system (Repurchase tender system) at a rate known as the repo rate. By increasing this rate, money becomes more expensive for commercial banks, who pass on the increase to their clients by increasing interest rates on loans. Loans become more expensive to the consumer and so the demand for money will decrease. - Cash reserve requirements

The SARB is permitted by the Banks Act to occasionally change the minimum cash balances the banks are required to maintain in order to manipulate the money creation activities of the banks. See the money multiplier equation. Change the 5% to 10% and see what the effect would be on the creation of credit/money in the economy.

SARB buys bonds from ABSA → more money flows into the economy so money supply increases.

SARB sells bonds to ABSA → money flows out of the economy and money supply decreases.

FISCAL POLICY – Fiscal policy = Is the process of using taxation and public expenditure to even out the swings of the business cycle. Governments, through their fiscal policy have a powerful weapon for stabilising/ironing out/smoothing of cycles, to stop peaks from ending in high inflation and troughs in too high levels of unemployment.

| While the monetary policy focuses on managing the total money supply, the fiscal policy tries to stimulate or curb the economy, by increasing or decreasing total consumption expenditure. Fiscal policy is dependent on the multiplier effect where a relatively small change in spending will cause a large change in income (GDP). |

The original equilibrium situation:

Accepts that all economic activities are stable and all markets in equilibrium.

Assumes the beginning of the following undesired conditions/problems:

- Total demand is low and unemployment is high.

The State can increase total demand by increasing expenditure, the multiplier will kick in. The state has THREE options:- Raising government spending (G) with borrowed money (Budget Deficit). Aggregate expenditure increases and so does demand.

The economy is stimulated and employment is likely to increase. - Decreasing taxes. Consumers and producers have a larger part of their incomes available to spend on goods and services.

Aggregate expenditure increases. The economy is stimulated and employment is likely to increase. - Raising government spending and simultaneously decreasing taxes. This will have a double effect. Government spending increases and consumers and producers also have more to spend. Demand increases substantially. Employment increases.

- Raising government spending (G) with borrowed money (Budget Deficit). Aggregate expenditure increases and so does demand.

- Aggregate demand is too high and leads to demand pull-inflation.

The state can decrease spending, decrease aggregate demand, the multiplier will kick in negatively and total spending will decrease.

To achieve this, the government has THREE options:- Cut down on government spending (G). The unspent money is preserved. Aggregate expenditure is less and demand drops.

Inflation is likely to decrease. - Increasing taxes (T). Workers pay more tax and this results in consumers having less income to spend and demand dropping.

Inflation is likely to decrease. - Reducing government spending (G) and simultaneously increasing taxes (T). This will have a double effect. Government spending decreases and consumers and producers also have less to spend. Demand drops substantially. Inflation decreases.

- Cut down on government spending (G). The unspent money is preserved. Aggregate expenditure is less and demand drops.

A COMBINATION OF MONETARY AND FISCAL POLICY:

The strongest effects are obtained when a government uses these policies in combination with one another to manipulate aggregate demand.

- Where demand is too high, restrictive policies can be combined as follows:

Monetary policy:

SARB can increase interest rates, increase reserve requirements of banks.

plus

Fiscal policy:

Reduce government spending and increase taxes – budget for a surplus.Doing these things simultaneously triggers negative money multiplier and a negative income multiplier, which doubles the effect of the measures. - If aggregate demand is too low, expansionary policies can be combined as follows:

Monetary policy:

SARB lowers interest rates and cash reserve requirement of banks.

plus

Fiscal policy:

Government decreases taxes and increases spending by budgeting for a deficit.A combination of the above policies will lead to a positive money multiplier and activate a positive income multiplier, which will double the effect of measures.

Restrictive policies make the economy slow down. Expansionary policies make the economy go faster (grow).

2.5 The new economic paradigm

The “new economic paradigm” discourages policy makers from using monetary and fiscal policies to fine-tune the economy, but rather encourages achieving stability through sound long-term policy decisions relating to demand and supply in an economy.

| • Interest rates | I |

| • Cash reserve requirements | Catch |

| • Open market transactions | One |

| • Moral persuasion | More |

| • Exchange rate policy | Elephant |

2.5.1 Demand-side policies

Demand-side policies focus on aggregate demand in the economy. When households, firms and government spend more, demand in the economy increases. This makes the economy grow but can lead to inflation.

- Inflation:

- Aggregate demand increases more quickly than aggregate supply and this causes prices to increase.

- If the supply does not react to the increase in demand, prices will increase.

- This will lead to inflation (a sustained and considerable increase in the general price level).

- Unemployment:

- Demand-side policies are effective in stimulating economic growth.

- Economic growth can lead to an increase in the demand for labour. As a result more people will be employed and unemployment will decrease.

- As unemployment decreases inflation is likely to increase. This relationship between unemployment and inflation is illustrated using the Phillips curve.

2.5.2 Supply-side policies

Supply-side policies include:

- Reduction of costs of production

- Infrastructural services

- Administrative costs

- Cash incentives

- Improving the efficiency of inputs

- Tax rates

- Capital consumption

- Human resources development

- Free advisory services

- Improving the efficiency of markets

- Deregulation

- Competition

- Levelling the playing field

2.6 Features underpinning forecasting with regard to business cycles

There are many economic indicators that can be used to forecast business cycles.

Some of these are:

2.6.1 Leading indicators

- Leading indicators give consumers, businesses and the state a glimpse of the direction in which the economy might be heading.

- When these indicators rise, the level of economic activities will also rise a few months later.

- Examples of leading indicators are job advertising space; inventory; and sales.

2.6.2 Co-incident indicators

- Co-incident indicators move at the same time as the economy.

- They indicate the actual state of the economy.

- Examples of these indicators are value of retail sales and real GDP.

2.6.3 Lagging indicators

- Lagging indicators won’t change direction until after the business cycle has changed its direction.

- Examples of these indicators are hours worked in construction and total of commercial vehicles sold.

2.6.4 Composite indicators

- It is a grouping of various indicators of the same type into a single value.

- The single figure forms the norm for a country’s economic performance.

2.6.5 Trend

- The trend is the general direction of the economy.

- The trend line that rises gradually will be positively sloped in the long run.

This rising line indicates a growing economy.

2.6.6 Length

- Length is measured from peak to peak or from trough to trough.

- Longer cycles show strength and shorter cycles show weakness with regard to economic activities.

2.6.7 Amplitude

- Amplitude refers to the vertical (height) difference between a trough and the next peak of a cycle.

- The larger the amplitude, the more extreme the changes that occur.

2.6.8 Extrapolation

- Extrapolation means to estimate something unknown from facts that are known. For example, extrapolations from known facts are used to predict future share prices.

2.6.9 Moving averages

- Moving avarages are used to analyse the changes in a series of data over a certain period of time.

Leading indicators show us where we’re heading ♪

Lagging indicators won’t change direction

Co-incident indicators, moving together

What’s the trend? Show me the way

What’s the length? Weak or strong today

Pump up the amplitude to see the difference

I need to extrapolate to make my predictions♫

(Create a song to help you remember these seven forecasting features. Singing the words to a catchy tune over and over again will help you.)

Activity 1

Study Figure 2.5 below and answer the questions that follow

Figure 2.5 Business cycles

- Define the term business cycle. (3)

- Indicate which indicator is represented by T. (2)

- What is measured by the horizontal axis? (2)

- At which point did the economy reach a peak and a trough? (4)

- Identify the four phases into which the business cycle is divided in the above illustration. (8)

- How is the length measured in the above business cycle? (2)

- Explain lagging and coincident indicators used in the forecasting of business cycles. (2 × 4) (8)

[29]

Answers to activity 1

|

Activity 2

Study the cartoon below and answer the questions that follow:

- What is the message behind the cartoon? (2)

- Why do you think that unemployment will not lead to an economic lift off? (2)

- To which forecasting indicator does unemployment refer? (2)

- How would you describe the recovery phase of a typical business cycle? (2)

[8]

Answers to activity 2

|

Activity 3

Discuss the monetarist approach as a cause of business cycles. [8]

Answers to activity 3

|

Activity 4

Discuss the trend line in the forecasting of business cycles. [8]

Answers to activity 4

|